Maximize 401(k) Contributions Before 2025 Limit Increase

Maximize Your 401(k) Contributions Before the Increased Limit Takes Effect in January 2025 by understanding current contribution limits, potential tax advantages, and strategies to optimize your savings, ensuring a financially secure retirement. Are you looking to secure your financial future? It’s crucial to maximize your 401(k) contributions before the increased limit takes effect in January […]

Maximize Your 401(k) Contributions Before 2025 Limit Increase

Maximize your 401(k) contributions before the upcoming 2025 limit increase to potentially secure a more comfortable retirement by taking advantage of tax benefits and compounding growth. Are you ready to **maximize your 401(k) contributions** before the increased limit takes effect in January 2025? This is a crucial opportunity to enhance your retirement savings and take […]

Retirement readiness plan: Are you prepared for the future?

Retirement readiness plan is crucial for your peace of mind. Discover essential strategies to ensure a comfortable future.

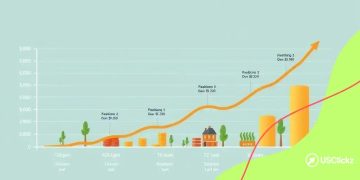

Investmentgrowthmap: Your guide to boosting returns

Investmentgrowthmap helps you discover innovative strategies to enhance your portfolio returns and achieve financial goals fast.

Capital Gains Tax 2025: Investor’s Guide to Proposed Rate Changes

Understanding the proposed changes to capital gains tax rates in 2025 is crucial for investors to strategically plan their investment portfolios and minimize potential tax liabilities, ensuring they are well-prepared for the upcoming fiscal adjustments. Navigating the complexities of investment taxation can be daunting. This article breaks down understanding the proposed changes to capital gains […]

Capital Gains Tax Rates in 2025: An Investor’s Guide

Understanding the proposed changes to capital gains tax rates in 2025 is crucial for investors to strategically plan their investment strategies, minimize potential tax liabilities, and optimize their overall financial outcomes in the face of evolving tax policies. Navigating the complexities of capital gains taxes can be daunting, especially when changes are on the horizon. […]

Taxsmartplanner: Your guide to efficient tax planning

Taxsmartplanner can simplify your tax process, saving you time and money. Discover how to maximize your savings today!

Decoding 2025 IRS Tax Brackets: Impact of a 3% Income Increase

Decoding the IRS tax brackets for 2025 is crucial for understanding how a 3% income increase affects your tax liability, influencing financial planning and tax strategy. Understanding how changes in income affect your tax liability is essential for financial planning. This analysis focuses on decoding the IRS tax brackets for 2025: what a 3% income […]

Decoding 2025’s IRS Tax Brackets: Impact of a 3% Income Boost

Decoding the New IRS Tax Brackets for 2025 involves understanding how a seemingly small 3% income increase can shift your tax liability, potentially altering your tax bracket and ultimately impacting your disposable income. Navigating the intricacies of the US tax system can feel like a daunting task. With the introduction of the new IRS tax […]

Personal finance: tips for smarter money management

Personal finance can help you achieve your financial goals and improve your money management skills effectively. Discover how to get started!