Capital Gains Tax Rates in 2025: An Investor’s Guide

Anúncios

Understanding the proposed changes to capital gains tax rates in 2025 is crucial for investors to strategically plan their investment strategies, minimize potential tax liabilities, and optimize their overall financial outcomes in the face of evolving tax policies.

Navigating the complexities of capital gains taxes can be daunting, especially when changes are on the horizon. Understanding the proposed changes to capital gains tax rates in 2025: A Guide for Investors is here to clarify what you need to know.

What are Capital Gains Taxes?

Capital gains taxes are triggered when you sell an asset for more than you bought it. This profit, or “capital gain,” is subject to taxes, distinct from your regular income tax. These taxes apply to a variety of assets, from stocks and bonds to real estate and collectibles.

Short-Term vs. Long-Term Capital Gains

The taxation of capital gains depends on how long you held the asset. Short-term capital gains apply to assets held for a year or less and are taxed at your ordinary income tax rate. Long-term capital gains, on the other hand, apply to assets held for more than a year and are generally taxed at lower rates.

Current Capital Gains Tax Rates

Currently, long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income. A 3.8% Net Investment Income Tax (NIIT) may also apply to higher-income taxpayers. Understanding these rates is the first step in preparing for potential changes.

To summarize, capital gains taxes are a crucial part of investment planning. Knowing the difference between short-term and long-term gains, and understanding the current tax rates, sets the stage for adapting to future changes.

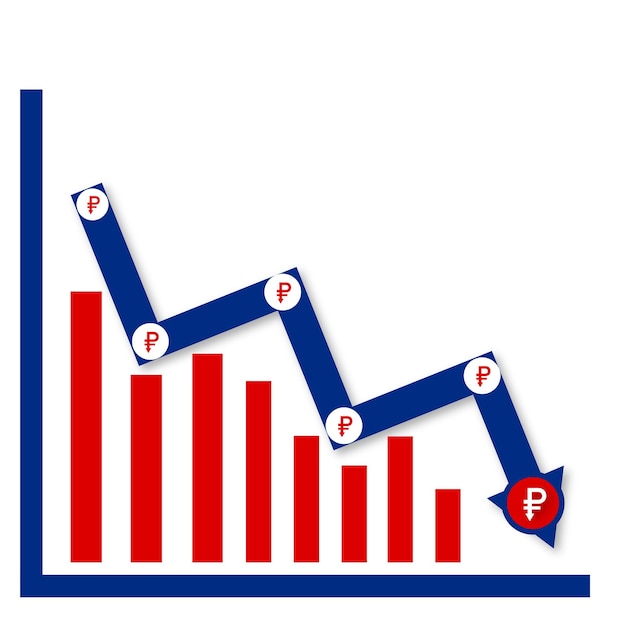

Overview of Proposed Tax Changes for 2025

As we look toward 2025, significant discussions are underway regarding potential alterations to capital gains tax rates. These proposed changes could have far-reaching effects on investment strategies and financial planning for many Americans. It’s essential to stay informed about these potential shifts in the tax landscape.

Key Proposals on the Table

Several proposals are being considered that could reshape how capital gains are taxed. Some involve increasing the top tax rate, while others focus on altering the income thresholds at which different rates apply. There’s also talk of modifying the rules regarding carried interest and the step-up in basis at death.

Potential Impact on Investors

The proposed changes could significantly impact investors, particularly those with substantial investment portfolios. Higher tax rates could reduce the after-tax returns on investments, potentially altering investment decisions. Investors may need to re-evaluate their asset allocation and tax planning strategies to mitigate the impact.

- Increased tax burden on high-income earners

- Potential shifts in investment strategies

- Greater emphasis on tax-efficient investing

In essence, the prospective tax changes for 2025 represent a shifting financial landscape. Investors must proactively educate themselves and prepare for the potential impacts on their portfolios and overall financial health.

How the Changes May Affect Different Income Levels

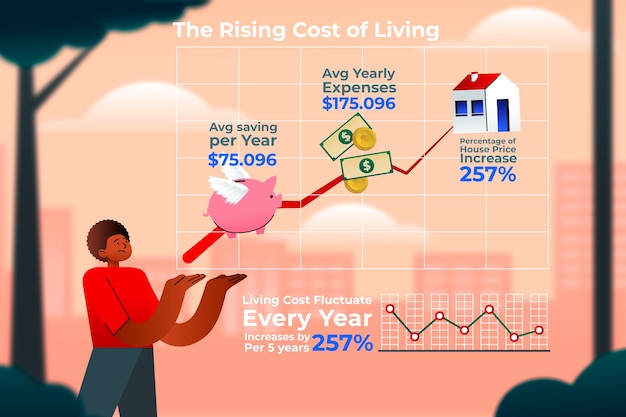

The proposed changes to capital gains tax rates in 2025 aren’t expected to affect all income levels equally. Different tax brackets will experience varying degrees of impact, which is vital for investors to understand in order to prepare effectively.

Low-Income Individuals

For lower-income individuals, the impact may be minimal. Many in this bracket currently benefit from the 0% long-term capital gains tax rate. Unless proposals specifically target this rate, their tax burden may remain unchanged. However, it’s always prudent to stay informed, as tax laws can be complex and subject to change.

Middle-Income Individuals

Middle-income individuals, who typically fall into the 15% long-term capital gains tax bracket, could see some adjustments. If the income thresholds for the existing rates are modified, some may find themselves pushed into higher tax brackets. This would mean a larger percentage of their investment gains being taxed.

High-Income Individuals

High-income individuals are likely to be the most affected by proposed tax changes. With potential increases in the top capital gains tax rate, they could see a significant portion of their investment gains going toward taxes. It’s particularly important for this group to consider strategies for tax-efficient investing and wealth management.

In conclusion, the proposed tax changes represent a nuanced landscape, with effects varying by income level. Investors need to assess their individual circumstances and plan accordingly to navigate potential changes to capital gains tax rates in 2025.

Strategies to Prepare for Potential Tax Hikes

With the possibility of increased capital gains tax rates on the horizon in 2025, it’s prudent for investors to explore various strategies to mitigate potential tax liabilities. Proactive planning can make a significant difference in preserving investment returns.

Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have decreased in value to offset capital gains. This strategy can reduce your overall tax burden by lowering your taxable income. It’s important to be mindful of the “wash sale” rule, which prohibits repurchasing the same or substantially similar investment within 30 days.

Asset Location

Asset location involves strategically placing different types of investments in different types of accounts to minimize taxes. For example, tax-inefficient investments, such as high-dividend stocks or actively managed funds, may be better suited for tax-advantaged accounts like 401(k)s or IRAs. Tax-efficient investments, like index funds or ETFs, can be held in taxable accounts.

Consider Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts, such as 401(k)s, IRAs, and Health Savings Accounts (HSAs), can provide significant tax benefits. Contributions to these accounts may be tax-deductible, and investment growth within these accounts is often tax-deferred or tax-free.

- Minimize taxable income through deductions

- Optimize asset allocation for tax efficiency

- Consult with a financial advisor for personalized strategies

In summary, preparing for potential tax hikes requires a multi-faceted approach. Tax-loss harvesting, strategic asset location, and leveraging tax-advantaged accounts are valuable tools for minimizing the impact of higher capital gains tax rates.

Understanding the Implications for Real Estate Investments

Real estate investments are a significant part of many portfolios, and changes to capital gains tax rates can have specific implications for this asset class. Understanding these implications can help investors make informed decisions about their real estate holdings.

Capital Gains on Property Sales

When you sell a property for more than its adjusted basis (original purchase price plus improvements, minus depreciation), you incur a capital gain. This gain is subject to capital gains taxes. The tax rate depends on how long you owned the property and your taxable income.

The Section 121 Exclusion

The Section 121 exclusion allows homeowners to exclude a certain amount of capital gains from the sale of their primary residence. For single filers, the exclusion is up to $250,000, and for married couples filing jointly, it’s up to $500,000. To qualify, you must have owned and lived in the home for at least two of the five years before the sale.

Strategies for Real Estate Investors

Real estate investors can employ several strategies to mitigate capital gains taxes. These include utilizing the Section 1031 exchange to defer taxes on the sale of investment properties, spreading out gains over multiple years through installment sales, and carefully tracking expenses and improvements to increase the property’s basis.

In conclusion, potential changes to capital gains tax rates introduce specific considerations for real estate investments. Understanding the Section 121 exclusion and exploring tax-deferral strategies are essential for optimizing returns on real estate holdings.

Long-Term Planning in the Face of Tax Uncertainty

Navigating potential changes to capital gains tax rates requires more than just short-term reactions; it necessitates thoughtful long-term planning. By considering future tax scenarios and aligning investment strategies accordingly, investors can build resilient portfolios.

Re-Evaluating Investment Goals

Tax law changes may prompt a re-evaluation of investment goals. Higher tax rates could reduce the pace of wealth accumulation, potentially requiring adjustments to savings rates or investment risk tolerance. Alignment with long-term financial objectives ensures resilience amid uncertainty.

Diversification and Risk Management

Diversification remains a cornerstone of sound investment strategy, especially in the face of tax uncertainty. Spreading investments across various asset classes can mitigate the impact of tax changes on any single asset. Additionally, robust risk management practices can protect portfolios from unforeseen market volatility.

Staying Informed and Seeking Professional Advice

Keeping abreast of tax law changes is paramount. Regularly consulting with financial advisors and tax professionals ensures access to informed insights and personalized strategies. Professional guidance can navigate complexities and optimize long-term financial outcomes.

In summary, effective long-term planning amidst potential tax changes requires a holistic approach. Re-evaluating investment goals, prioritizing diversification, and seeking professional advice are key components of building resilient portfolios capable of weathering tax uncertainty.

| Key Point | Brief Description |

|---|---|

| 💰 Capital Gains Tax | Tax on profits from selling assets. |

| 📈 2025 Changes | Potential tax rate increases are being considered. |

| 🏡 Real Estate Impact | Changes may affect property sales and investments. |

| 🛡 Tax Strategies | Use tax-loss harvesting and asset location to mitigate taxes. |

FAQ

▼

Short-term capital gains are profits from assets held for one year or less, taxed at your ordinary income rate. Long-term capital gains are from assets held over a year, often taxed at lower rates.

▼

Potential tax increases might shift your focus to tax-efficient investments and strategies. This could involve reallocating assets or adjusting your risk tolerance to maximize after-tax returns.

▼

Tax-loss harvesting involves selling losing investments to offset capital gains, reducing your taxable income. Be aware of the “wash sale” rule, which prevents repurchasing similar assets within 30 days.

▼

Real estate investors can use strategies like the 1031 exchange to defer taxes or spread gains over time. Maximizing deductions for expenses and improvements is also beneficial.

▼

Long-term planning allows you to adjust your investment goals, diversify your portfolio, and seek professional advice. This proactive approach ensures you’re prepared for potential tax changes.

Conclusion

In conclusion, understanding the landscape of proposed capital gains tax changes for 2025 equips investors with the knowledge to navigate uncertainties and optimize financial strategies. Proactive planning, combined with professional guidance, ensures resilience and success in the evolving tax environment.